They say family is your anchor — the people who catch you when you fall, the voices that remind you who you are when the world forgets. But what happens when the storms of life are so strong that even your anchor feels shaky?

In 2018, my life entered what I now call the perfect storm phase. My tech cofounder left, a trusted employee faced a personal crisis, my property got stuck in litigation, and an old partner filed a false legal case against me. If that wasn’t enough, a fire took down the one cash-generating coffee shop I had left.

I made a bold decision then — to create Advaith’s Nest, a rental asset meant to bring residual income. The plan was simple: build a stable foundation so I could focus on my main business, free from daily financial turbulence.

But life, as always, had its own script.

When a shield becomes a battlefield

I envisioned Advaith’s Nest as a protective wall for my family. In reality, it became a battleground for debts.

Originally, it was planned as a quick, smart move — deliver the building in 8 months, start earning rental income, and finally build a life where I was shielded from daily financial turbulence.

But then came a series of punches I couldn’t block.

The builder delayed far beyond what I could question or control. COVID lockdowns slammed the brakes on construction, freezing everything in place.

Instead of 8 months, it took 41 months to finally see it completed. Those extra 33 months weren’t just a delay on paper — they were a slow bleed on every plan I had carefully charted out.

By the time the project was ready, my financial shield had become a battlefield of debt repayments and emotional damage. Every rupee of rental income went into plugging holes from the past instead of protecting my future.

I built Advaith’s Nest for my wife — so she could live stress-free, focusing on her dreams and passions. But instead, she had to step into a job, facing the very financial storms I promised to keep away.

What was meant to be a fortress became a front line. A safe haven turned into another battleground. And watching that transformation unfold in slow motion — unable to stop it, unable to fight it — is a pain I still carry in every breath.

The slow poison of lost trust

When you lose money, you feel pain. When you lose trust, you lose the very fuel that keeps you moving.

Family trust isn’t just about financial support — it’s about feeling seen and understood. Without it, every business pitch feels heavier, every new idea seems riskier, and every sunrise feels a little less bright.

I didn’t want my wife to work because I believed I could be her shield. Now, watching her step into the battlefield with me stings in ways words can’t capture.

Rebuilding: brick by brick, breath by breath

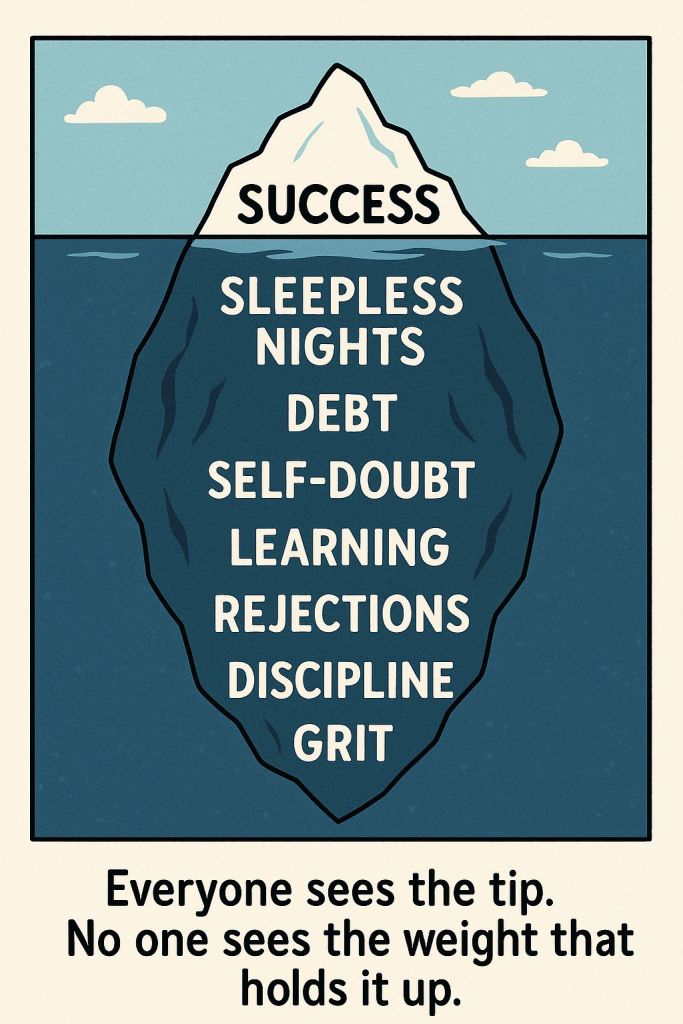

Many say, “Start again! Rebuild!” But what they don’t tell you is that rebuilding after a major collapse is not just a logistical task — it’s an emotional surgery.

You carry every past betrayal, every criticism, every silent stare at dinner. You build not just a new business, but a new identity. You move with double caution, second-guess every decision, and question whether your “big comeback” is even possible.

The toughest part isn’t raising money or building products. It’s rebuilding trust — in yourself, in your vision, and most painfully, in the eyes of those you love the most.

A quiet promise to myself and my family

I know I cannot fix the past. No apology or explanation can fully heal the wounds that unexpected financial struggles have caused. But I can honor the pain by transforming it.

I still believe in the core reason I started: to build something meaningful, not just for the market but for my family’s dignity and future.

To my family: I see the weight you carried. I see your sacrifices. I see your silent prayers at night. And I see the disappointment too.

I don’t seek blind forgiveness or instant validation. I seek your presence as I try again. Not as a flawless savior, but as a man who refuses to stop fighting for his family — even when he bleeds internally.

I may not be the man who always wins, but I am the man who never stops coming back home.