Some stories are about success. Some are about failure. And some, like mine, fall into an endless limbo — a space where you’re not losing, yet you’re not winning either.

I still remember the excitement of participating in the Reliance Petroleum IPO years ago. It wasn’t just an investment; it felt like owning a tiny piece of a giant vision. Fast forward to 2009: Reliance Petroleum was merged into Reliance Industries, and a swap ratio was announced — for every 16 shares of RPL, one share of RIL would be issued.

Sounds simple enough, right? In a perfect world, yes. But in my world, simplicity turned into a long-winding maze.

At the end of 2008, life threw me off a cliff. I went through a partnership breakup, a personal relationship breakup, and a complete financial turmoil all at once. In that whirlwind of survival, I lost track of my demat investments entirely. Only around 2023 did I finally find the time — and the mental space — to look into these forgotten holdings.

When I checked my demat account years later, I realized those RPL shares were still haunting me, unconverted, unsellable, like a ghost from a forgotten ledger. I couldn’t sell them, couldn’t claim dividends — I couldn’t even move on.

ICICIDirect pointed me to KFintech, the registrar handling these transitions. And that’s where my real journey began — or should I say, where my patience was tested beyond limits.

Email after email, I kept trying. They responded asking for share certificates that never existed in the first place because my holdings were in dematerialized form. When I explained, they requested “additional proof” — statements, transaction records, holding confirmations. I provided everything, each time hoping it would be the last request, each time thinking: This is it, they’ll finally process it.

But like a twisted loop, the replies always circled back to new demands or cryptic statements: “Folio number doesn’t match,” or “Provide a scanned image of the certificate.”

Days turned into weeks. Weeks turned into months. And before I knew it, I had spent two years stuck in this bureaucratic labyrinth.

Somewhere along the way, I started questioning — was it my mistake? Did I miss some notification back in 2009? Did my broker fail me? Or is it simply that large systems forget small investors like us?

I don’t just see this as a technical or administrative issue anymore. It’s a test of resilience, a silent war fought through scanned attachments, politely worded follow-ups, and the relentless hope that this time it will work.

Yet, here I am. Two years later. My shares remain ghosts. My case remains “open.” My hope — well, it flickers, but it hasn’t died.

As I write this, I share not only my frustration but also my vulnerability. To all the financial advisors, experienced investors, or kind souls who’ve walked this path before and if you’ve solved such issues or know someone in this domain who can help, your guidance would be deeply appreciated.

I’m not just seeking a resolution. I’m seeking closure for my shares, and for the weary investor within me.

Tag: investment

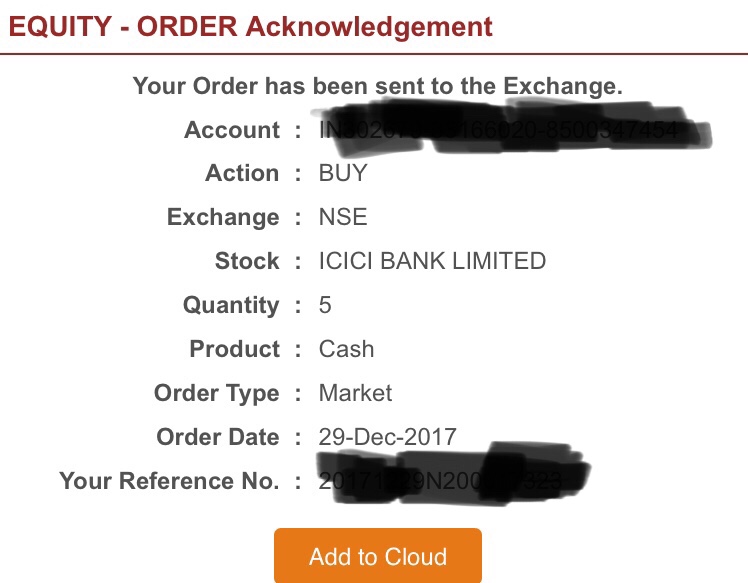

Closing the year with a small investment!!

Wanted to close the year with a positive note and brought some shares during the last trading day of the year!!

Why investment is better than consumption?

How Many People are riding ROYAL ENFIELD BIKE ? or wish to ride it ?

Look at the growth of Eicher Motors (Makers of Royal Enfield).

Share Price on September 2001 = ₹17.50

Price of Royal Enfield bike in 2001 = ₹55000/-

If any one would have bought the shares of Eicher Motors instead of a bike then he would have got 3143 shares ((₹55000/ ₹17.50 (share Price) = 3143 Shares))

Eicher Motor’s Share Price as on 4th Aug 2015 was ₹20,158.

Total Value as 3143 x 20,158= 6.33 crore.

₹55000/- is worth ₹6.33Crore in 13 Years.

Now he could have bought a Rolls Royce.

My earnings – a review

I was wondering how much I earned in this 9 years of professional life and how much I saved/invested… I was shocked to see that my finances are in negative and it is high time that I do something soon to recover…

Â

Let us imagine I earned Rs.35,000/- on an average (averaging entry level salary to what I’m earning today) and 8 years and 6 months of professional experience which comes to 102 months… So, my total earnings till date is Rs.35,70,000/-…

Â

|

Description |

Investment |

Loans |

P&L |

|

Stocks |

300000 |

|

|

|

MF’s |

550000 |

|

|

|

Insurance |

760000 |

|

|

|

HDFC |

|

300000 |

|

|

IDBI |

|

300000 |

|

|

IOB |

|

450000 |

|

|

Biz. Loss |

|

700000 |

|

|

|

|

|

|

|

Total |

1610000 |

1750000 |

-140000 |

Â

Now I don’t know what happened to the balance from;

Â

Total Earnings – (Investment + Loss) = 35,70,000 – (16,10,000 + 140000) = Rs.18,20,000/-

Â

I think I’ve spent a lot than saving/investing and I think it is high time seriously work on my finances…