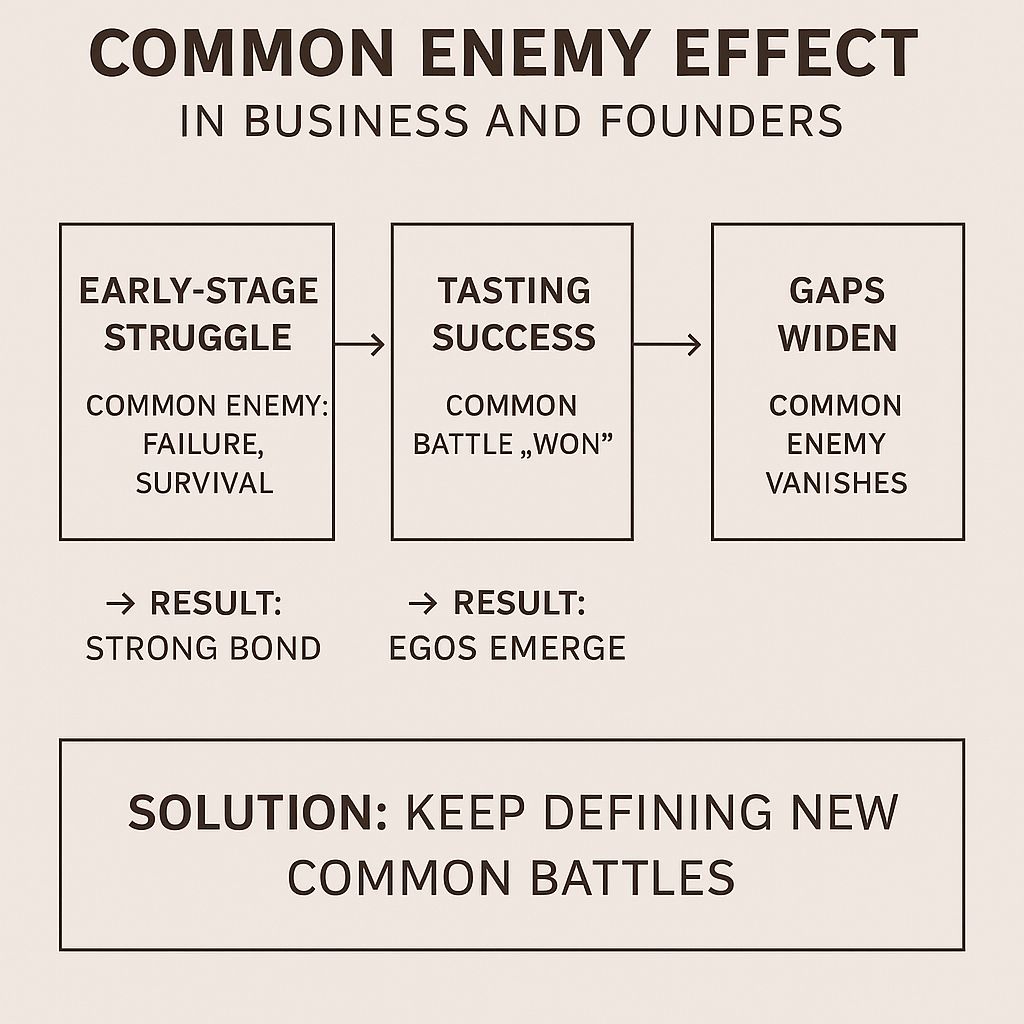

The common enemy effect is a powerful social phenomenon: people unite strongly when they share a common threat. We often see it in military units, sports teams, and political movements — and it’s equally true for founders and startup teams.

Phase 1: The early struggle

When founders start out, they face huge external threats:

- Market rejection

- Cash burn

- Pressure to prove themselves

- Family or societal doubt

Their common enemy is failure itself. This shared threat aligns them deeply. There’s no time for ego; decisions are fast and collective. Emotional support is strong. They feel like warriors in the same trench.

Phase 2: Early wins and success

Then comes funding, product traction, revenue, or media buzz. Suddenly, the “enemy” that held them together begins to fade.

Without that shared fight, founders start:

- Claiming credit individually

- Listening to “proxy teams” or external voices that inflate egos

- Pushing personal agendas

The urgent need to survive is gone, so the cracks appear.

Phase 3: Gaps widen

When the common threat disappears:

- Misaligned visions surface

- Egos grow

- Trust erodes

- Silent power struggles begin

The same founders who once pulled all-nighters together may now fight over direction, credit, or influence.

Lessons from research

✅ Ben Horowitz (The Hard Thing About Hard Things): In crises, teams unite; in safety, they splinter.

✅ Patrick Lencioni (The Five Dysfunctions of a Team): Without a shared mission, conflict thrives.

✅ Harvard Business Review: “Shared existential threats unify.” New shared missions are critical as you grow.

✅ Social Identity Theory (Tajfel & Turner): Strong group identity often needs an external “enemy” to stay focused.

What can founders do?

- Constantly define new “enemies” or big missions (new markets, innovations, tougher impact goals).

- Regularly revisit and realign personal and collective visions.

- Watch out for external influences that inflate individual egos.

- Build a culture where mission > individuals, always.

In short

What unites founders at first? A common enemy (failure, survival).

What causes splits later? The enemy fades, egos rise.

What’s the fix? Keep creating new shared battles to stay united.

This is the size of Sweet little Flaunge & you can see all the equipments fitted within that room…

This is the size of Sweet little Flaunge & you can see all the equipments fitted within that room…